Quality education is the key to a stable career that will result in a comfortable life for you and your family. Medical Emergency 2Childrens Higher Education 3Marriage SelfSiblingsChildren 4.

Pf Withdrawal How To Withdraw Pf Amount Online Legal Services Withdrawn Tax Deducted At Source

Yes you can withdraw it completely.

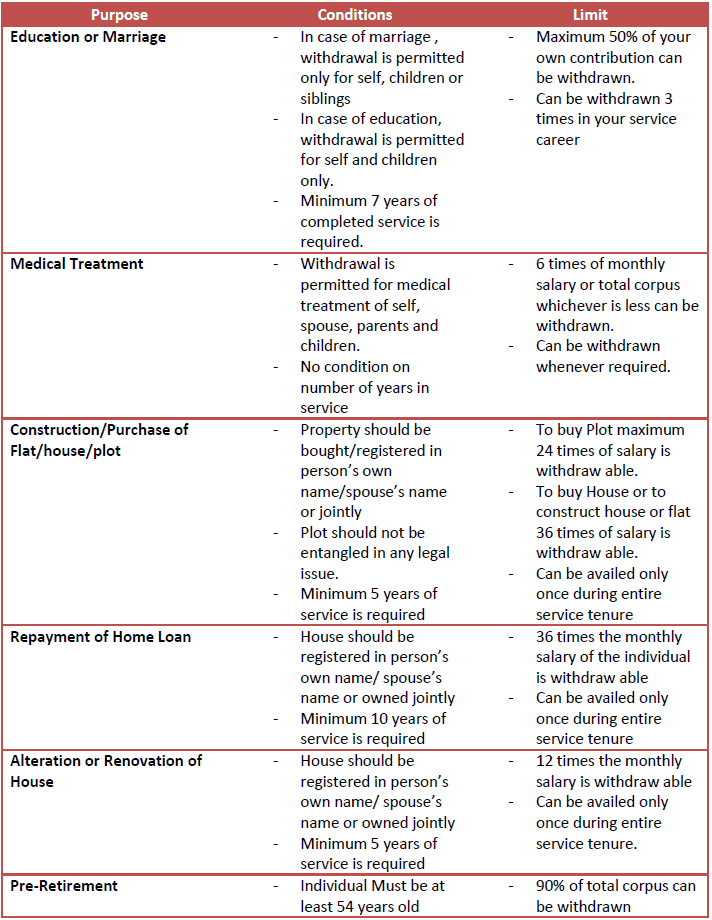

. A PF or EPF account holder can also withdraw the EPF balance to pay for urgent medical treatments for certain diseases. 11 PF Withdrawal for Marriage Paragraph 68K. Form 10C is used for making claims of PF withdrawals.

Sign the Certificate of Undertaking by clicking on Yes and proceed with the steps. KUALA LUMPUR 22 April 2016. Contents hide 1 EPF Partial Withdrawal Rules 2020.

The Employees Provident Fund. If you are withdrawing it before 5 years of service it is taxable. 12 PF Withdrawal for Education Paragraph 68K.

Withdrawal under sl no e above. EPF Withdrawal for Education Including PTPTN. What is the Withdrawal Limit of Do You Withdraw from EPF for Education.

12 months basic wages and DA OR Employee Share with interest OR Cost Whichever is least 1 One 1ONE Member Declaration Form from Member II. Now to withdraw your funds online you need to select the PF Advance Form 31 option. It can be your sibling or brothersister.

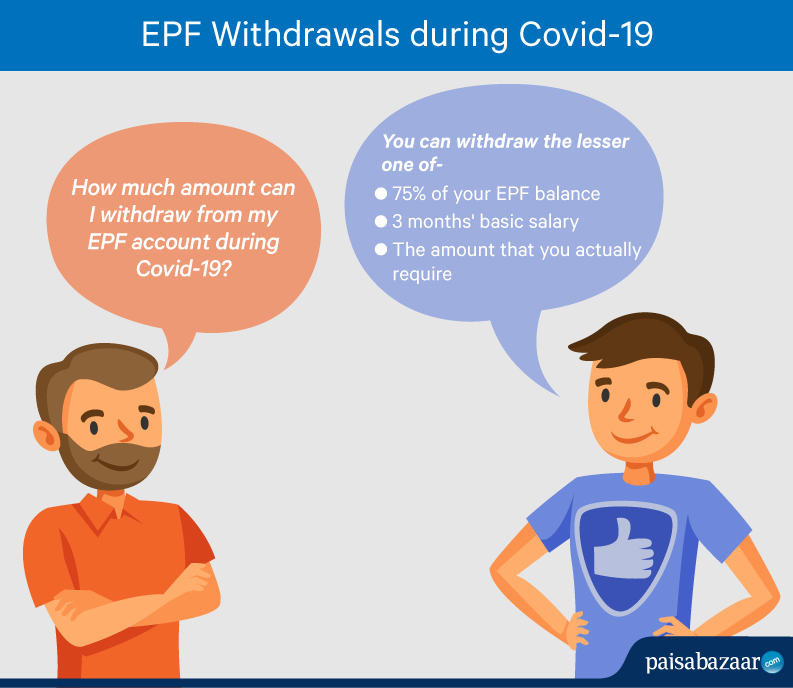

Tertiary education is exceptionally expensive these days and while PTPTN has done a good job of assisting those who need help with. 5 crore workers registered under Employee Provident Fund or EPF to get non-refundable advance of 75 of the amount or three months of the wages whichever is lower from their accounts. Yet its applicable in the case of.

It is possible to withdraw either 50 or all of the amount contributed and all accrued interest. Pendidikan yang berkualiti merupakan kunci kepada kestabilan kerjaya sekali gus membina kehidupan yang lebih selesa untuk ahli dan keluarga. You can even take a loan against your employees provident fund EPF for the education of your kids.

Some money from your EPF can be withdrawn for educational purposes. Membiayai Pendidikan Tinggi Anda. An employee can withdraw up to 90 of the.

An employee can withdraw up to 50 of his PF amount from his EPF account. EPF Withdrawal Rules - Partial and Full in 20211. It is treated more like a.

This means the funds can be withdrawn for any course at a college or university for graduation and above. You can make up to 3 withdrawals from these criteria. Answer 1 of 3.

You can also withdraw your EPF amount for educational purposes. If you meet this condition you can follow the procedure given below to withdraw your EPF online. Step 1- Sign in to the UAN Member Portal with your UAN and Password.

After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1. You can withdraw with the help of your. Before applying for withdrawal under this scheme EPF members are required to check the balance in Account II and obtain a letter from EPF that specifies the amount that can be withdrawn.

Members can apply by completing the KWSP 9H AHL form and submit together. This is a unique loan as you dont need to return the same. Are encouraged to use the e-Pengeluaran facility as it is a more efficient alternative to submitting their housing.

Also you can withdraw your EPF money for any other professional. 90 of the EPF balance can be withdrawn after the age of 54 years. This advantage can be availed only for post matriculation educational expenditures.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. This form is to be submitted by employees who fall under the age bracket of 50 years ie aged below 50 years. Partial early withdrawal from EPF is now permitted for a childs marriage higher education and making a down payment for a house subject to conditions.

This facility is allowed for both self-usage or to pay for. You can choose to withdraw your savings from Account 2 to help finance your own children spouse andor.

Epf Withdrawal Made Simple No Sign Required From Employer Make It Simple Employment How To Plan

File An Rti Application For Epf Withdrawal Or Epf Transfer Stutus Application Letters Lettering Money Buys Happiness

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Tax On Epf Withdrawal Rule Flow Chart Personal Finance Rules

Epfo Portal Filing Taxes Private Limited Company Online Registration

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Covid 19 Know How Much You Can Withdraw From Your Epf

Epf Withdrawals New Rules Provisions Related To Tds Tds Is Applicable W E F 1st June Budgeting Tax Deducted At Source Gucci Mane Kids

Pf Joint Declaration Form Kaise Bhare Epf Father Name Correction Date Of Exit Declaration Joint Names

Epf Partial Withdrawal Or Advance Process Form How Much

Epf Withdrawal Education Finance Tips How To Apply

Pin On India Fixed Income Investing

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Provident Fund Epf Withdrawal Transfer How To Do It Online Financial Education Financial Transfer

Epf Withdrawal Rules 2022 Medical Emergency Home Loan And Retirement Eligibility How To Withdrawal Pf Online And Offline

Check Your Epf Balance Now At Financial Fitness Online Loans Credit Worthiness

6 Reasons For Which You Can Withdraw Money From Your Epf Account